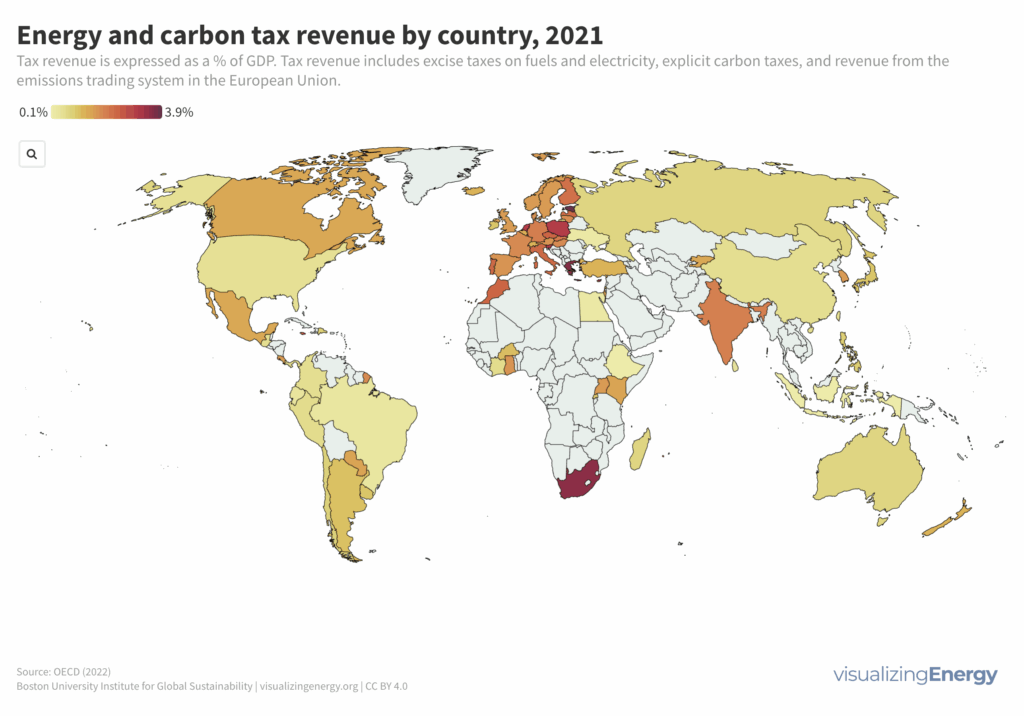

Where do energy taxes have the largest macroeconomic impact?

Economic policies impact the volume and nature of energy use and pollutants, including greenhouse gases. Government interventions typically include emissions trading, carbon taxes, and excise taxes. The OECD found that tax and subsidy policies influence GHG emissions and energy consumption globally. Current energy tax policies, however, do not align with GHG reduction goals.

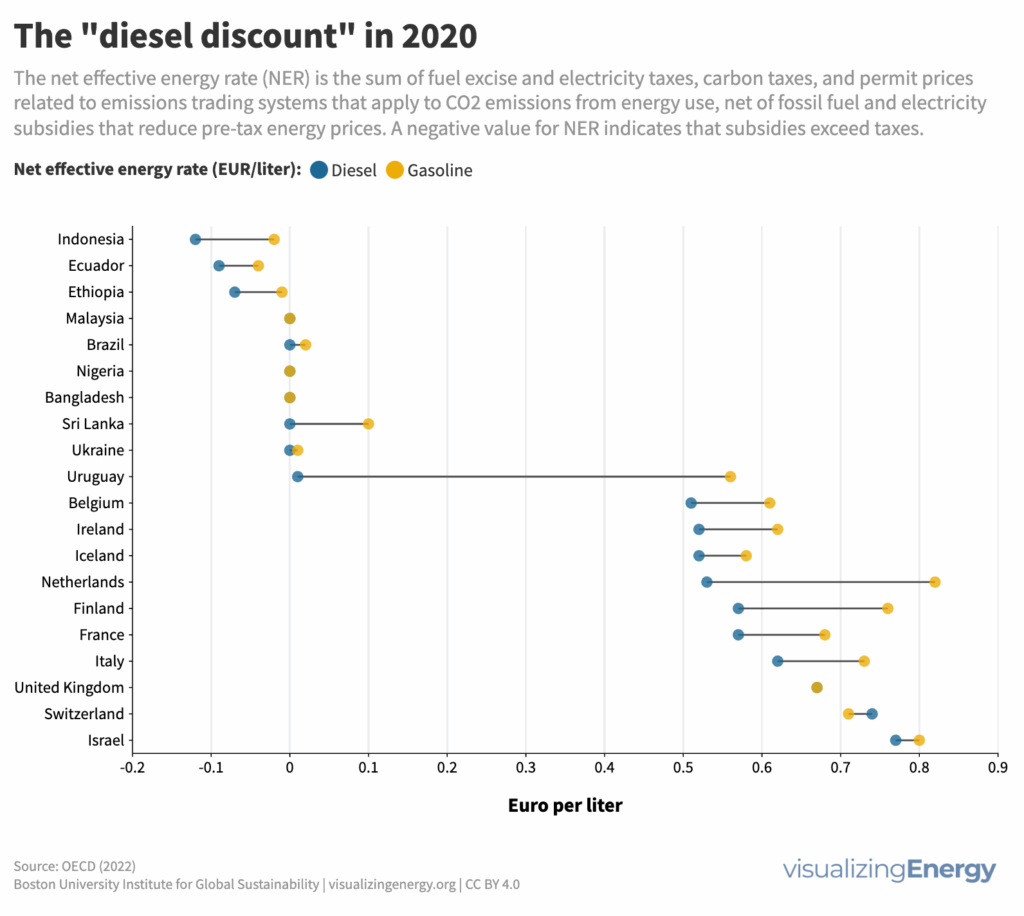

What is the ‘diesel discount’ and does it matter?

Road transport relies heavily on gasoline and diesel, influenced by government policies that often favor diesel for its efficiency. However, diesel produces more pollution, and the tax revenues it generates complicate change. The debate now centers on speeding up the transition to electric transportation to combat greenhouse gas emissions while balancing historical preferences with environmental concerns.

The history of coal production in the United States

Coal has played a pivotal role in the United States’ industrial history, fueling steel production, electricity generation, and economic growth in the early 20th century. However, this legacy also comes with significant environmental and health issues, including miner health problems, landscape degradation, abandoned mines, and pollution.