The cost and potential for global methane emissions reductions from fossil fuels

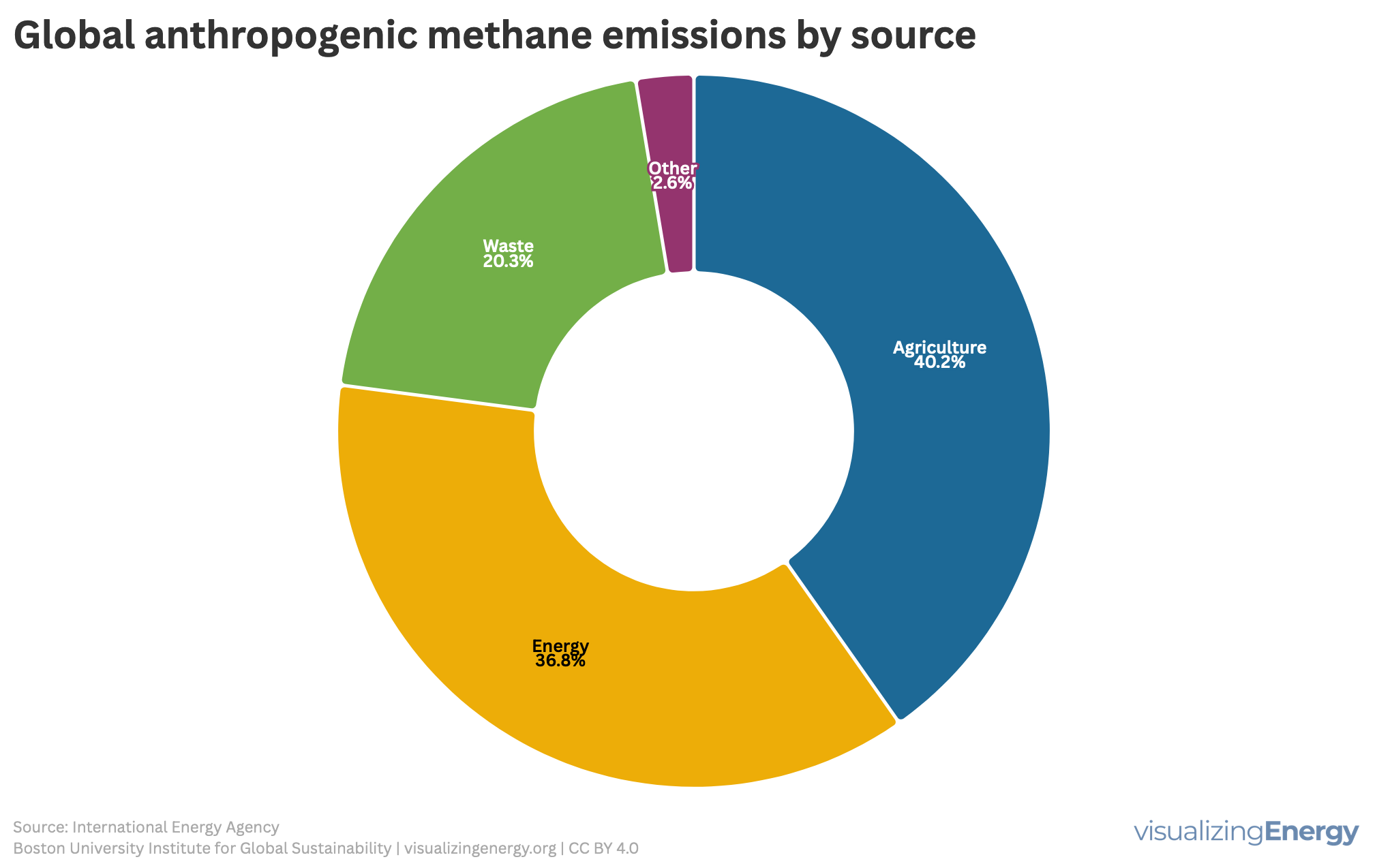

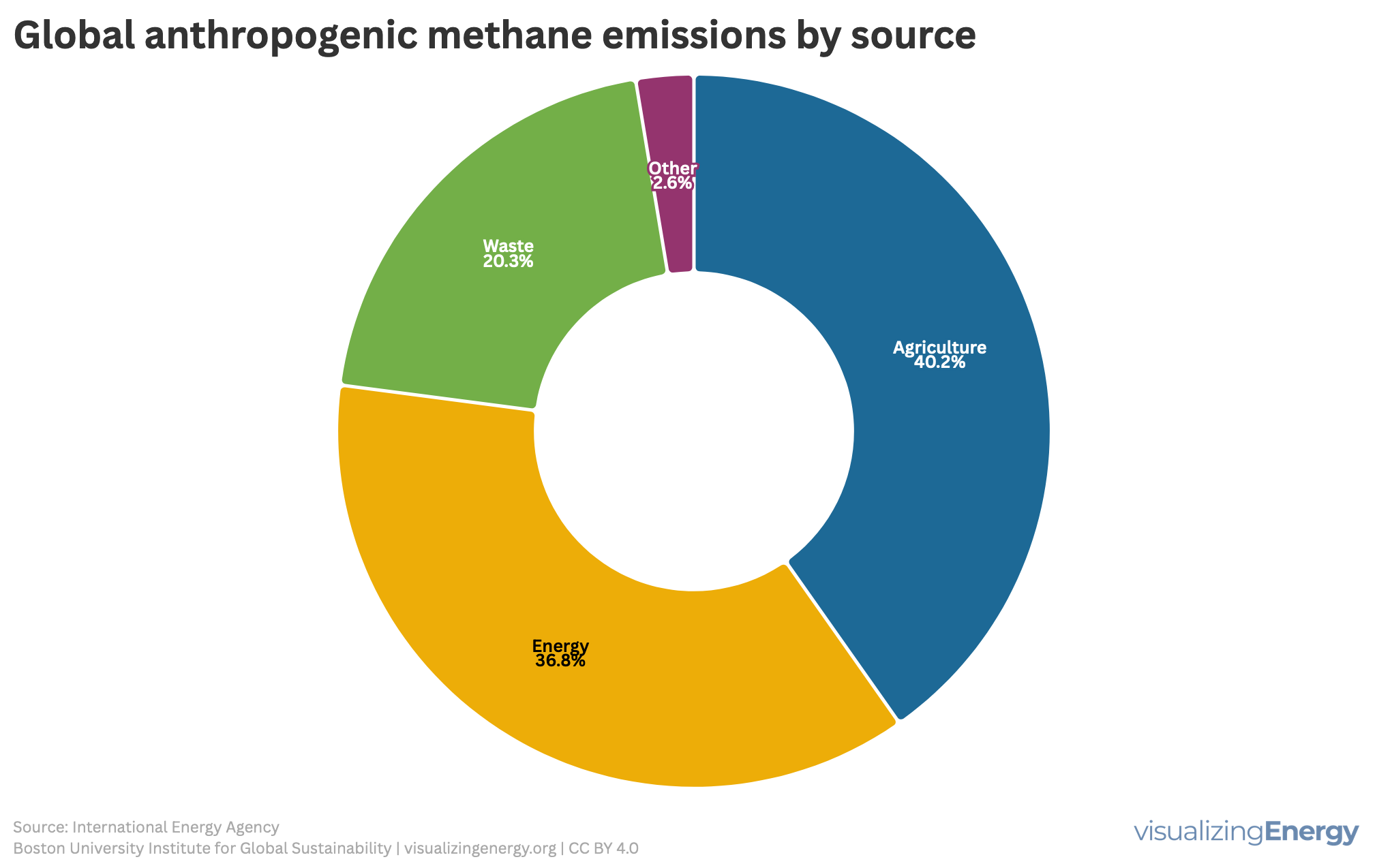

Methane belongs to a class of so-called “super pollutants” that simultaneously contribute to climate change and degrade the health of people and ecosystems. It has

Methane belongs to a class of so-called “super pollutants” that simultaneously contribute to climate change and degrade the health of people and ecosystems. It has

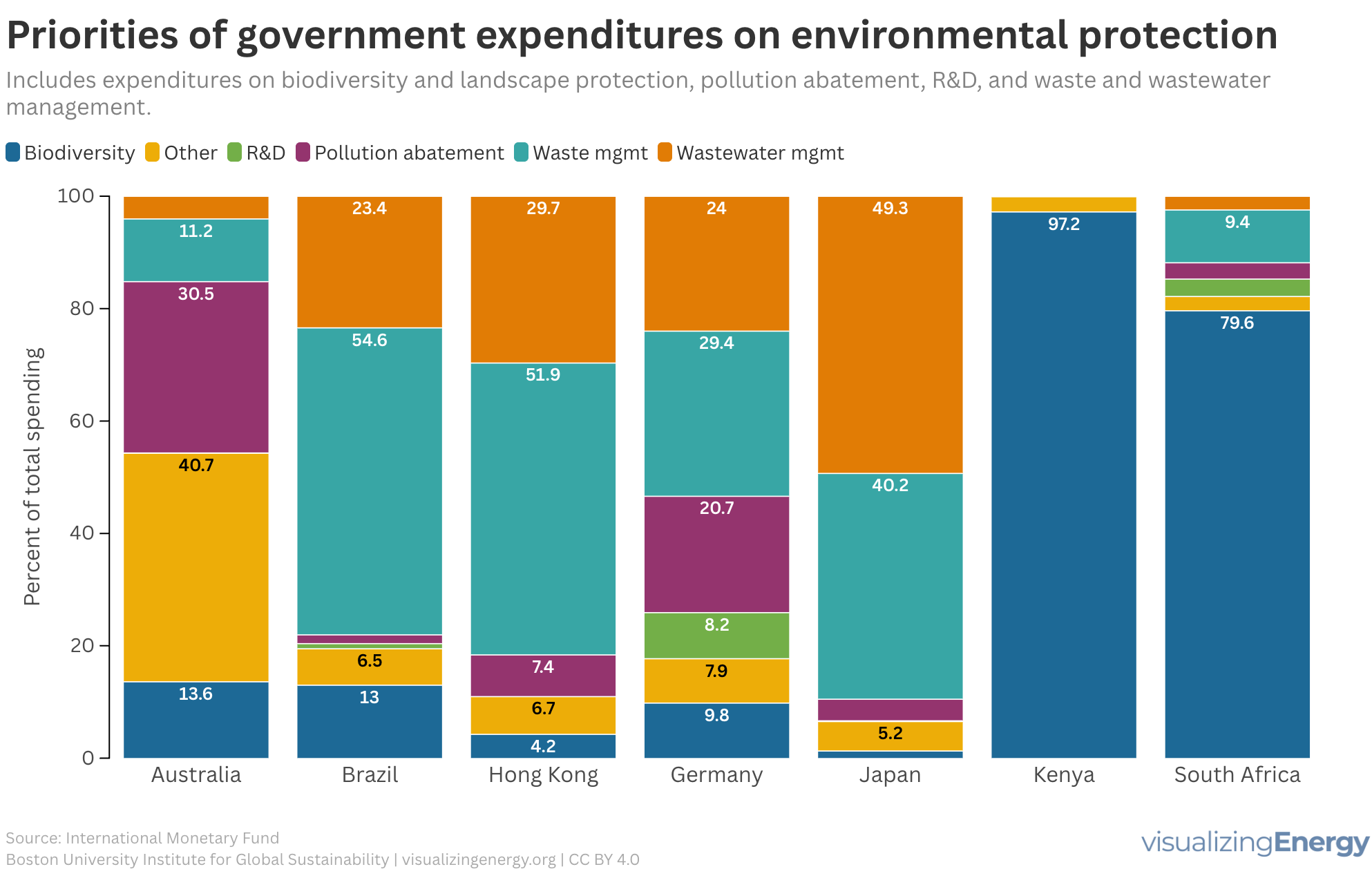

National governments began spending on environmental protection in the late 19th century, escalating after World War II due to pollution concerns. Key legislation emerged worldwide, including Japan’s 1967 law and the U.S. Endangered Species Act. In 2023, EU spending on environmental protection totaled €142 billion, highlighting diverse national priorities in tackling environmental issues.

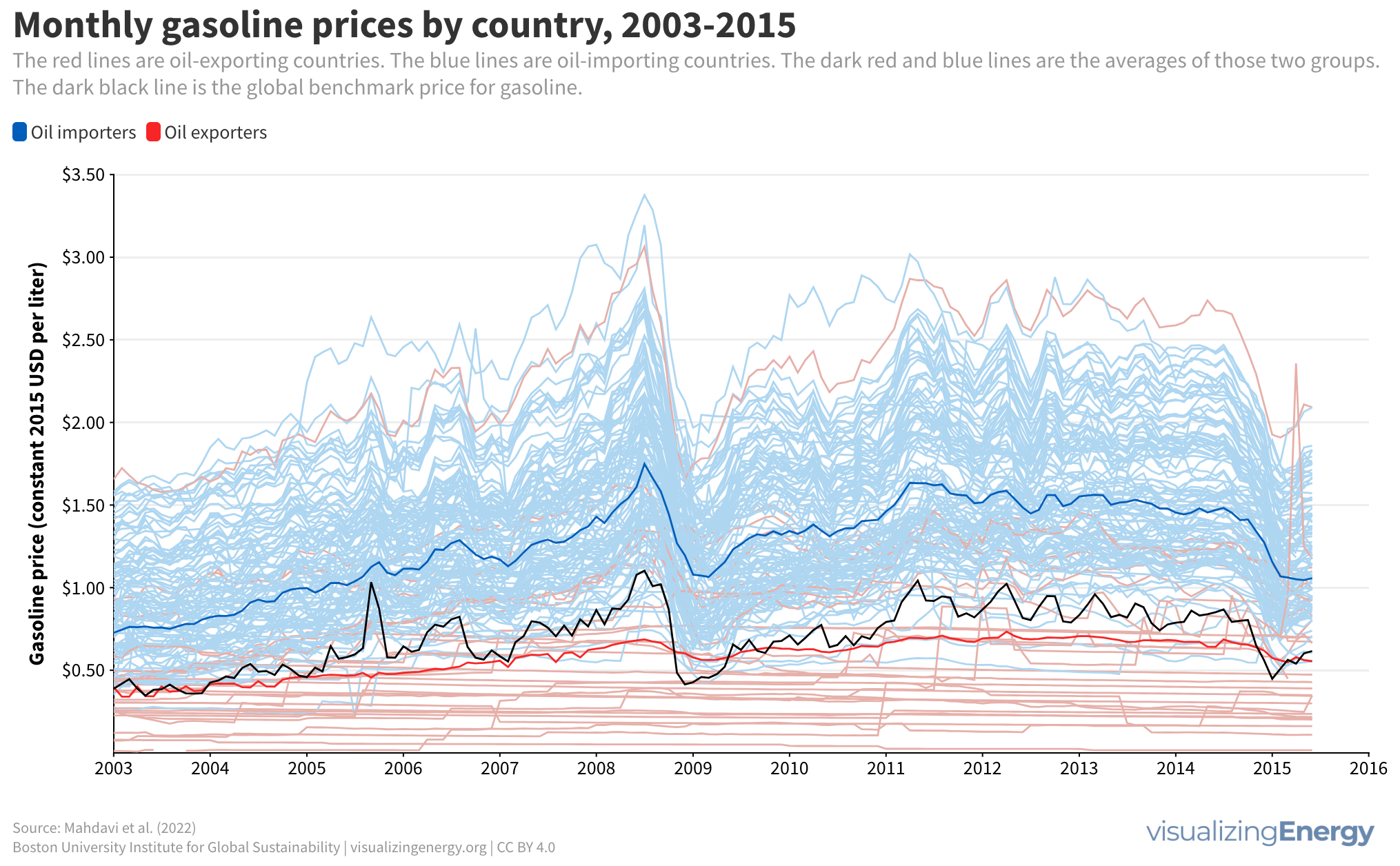

Government policies significantly influence gasoline prices, leading to disparities across countries. Most nations tax gasoline, while some subsidize it, especially oil exporters. Higher income countries typically impose steeper gasoline taxes to harness revenue. There’s a growing call to reduce fossil fuel subsidies to curtail greenhouse gas emissions, advocating for carbon pricing to promote clean technology.

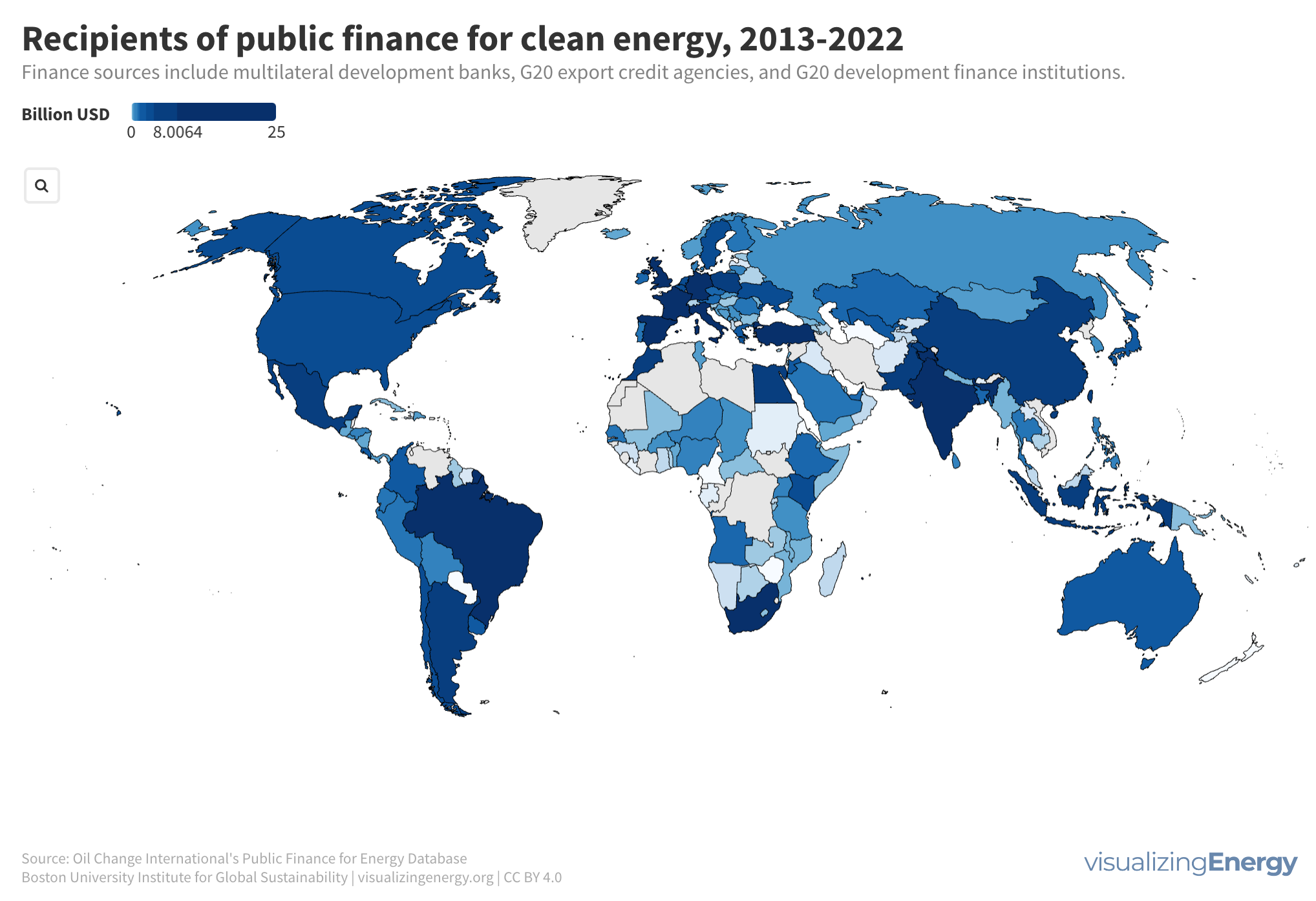

The global energy system encompasses diverse infrastructure requiring extensive investment, with USD 2.8 trillion spent in 2023. Public finance significantly supports energy projects, where fossil fuels received 56% of funding from 2013 to 2022. Clean energy finance increased until 2021, highlighting varying regional priorities and the dominance of large projects in funding distribution.

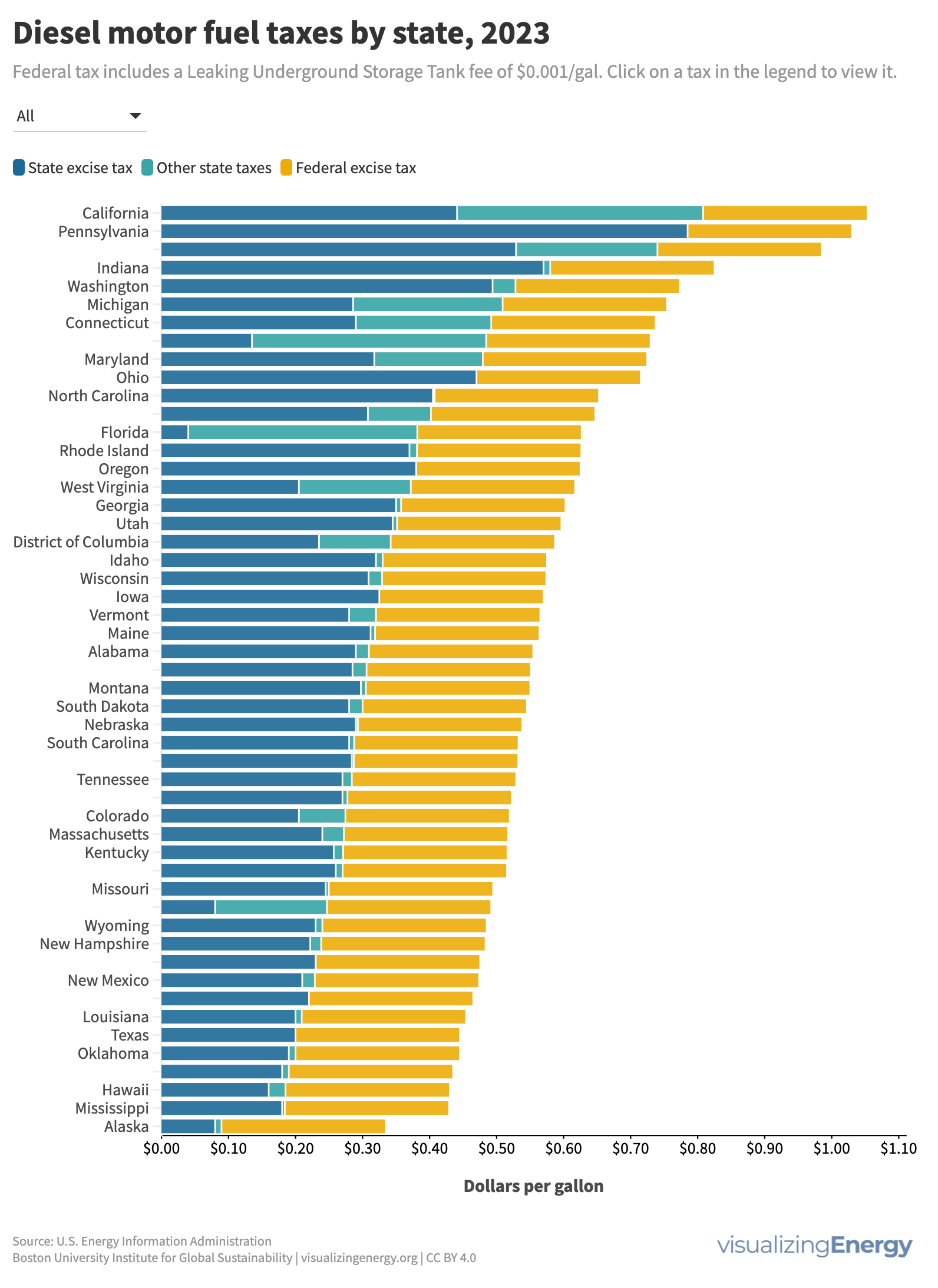

Americans closely monitor gasoline prices, viewing them as indicators of leaders’ success, economic health, and environmental policy effectiveness. The price of crude oil largely influences gas prices, yet federal and state taxes play a significant role. These taxes, popular due to revenue generation, heavily fund highway and mass transit spending.

Major financial institutions’ practices are not climate-friendly, with policies disconnecting short-term targets from required long-term climate actions. A Columbia University report highlights financial institutions’ political influence, using lobbying and campaign contributions, often obstructing climate policy. The report suggests measures for shifting towards positive climate action.

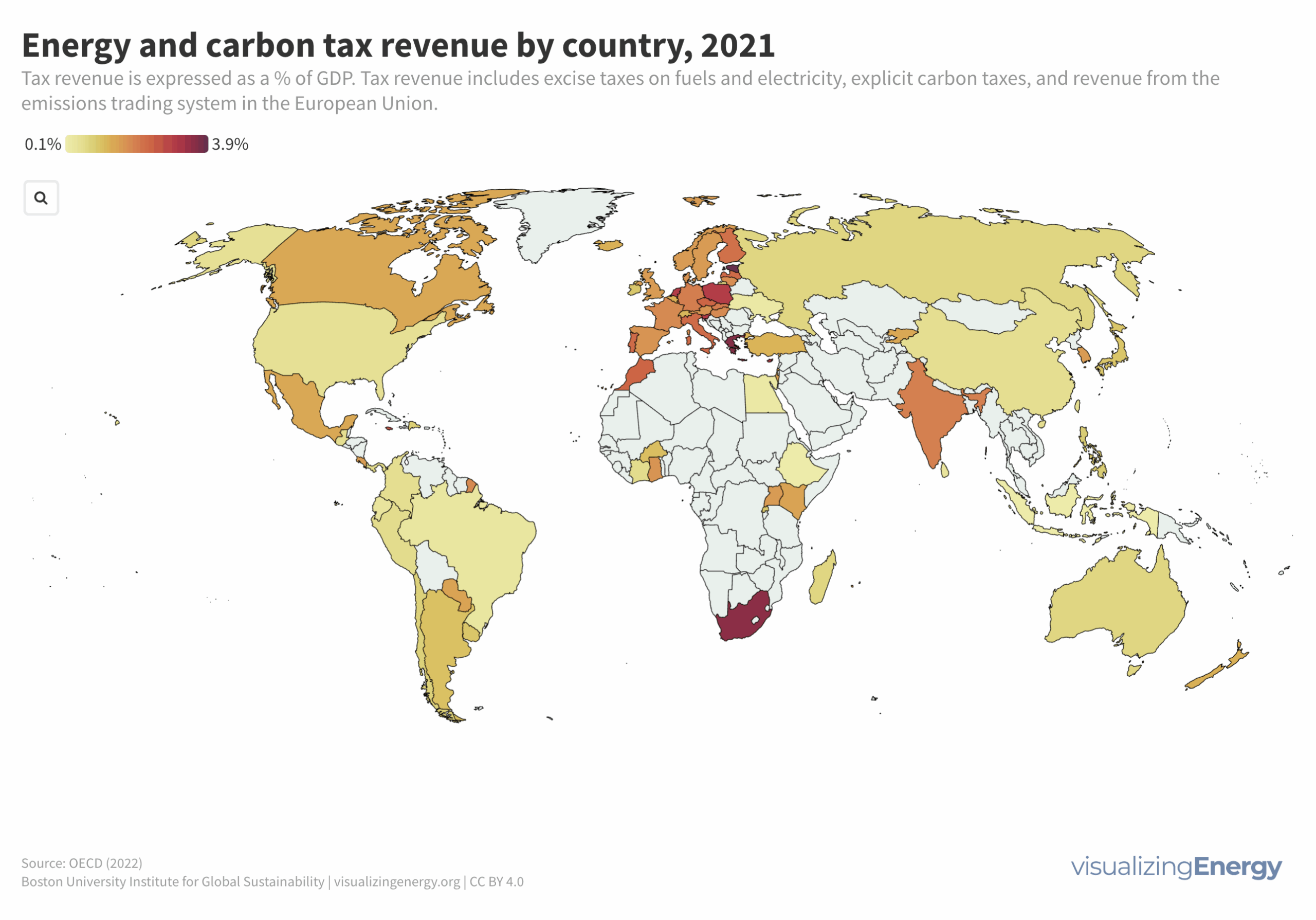

Economic policies impact the volume and nature of energy use and pollutants, including greenhouse gases. Government interventions typically include emissions trading, carbon taxes, and excise taxes. The OECD found that tax and subsidy policies influence GHG emissions and energy consumption globally. Current energy tax policies, however, do not align with GHG reduction goals.

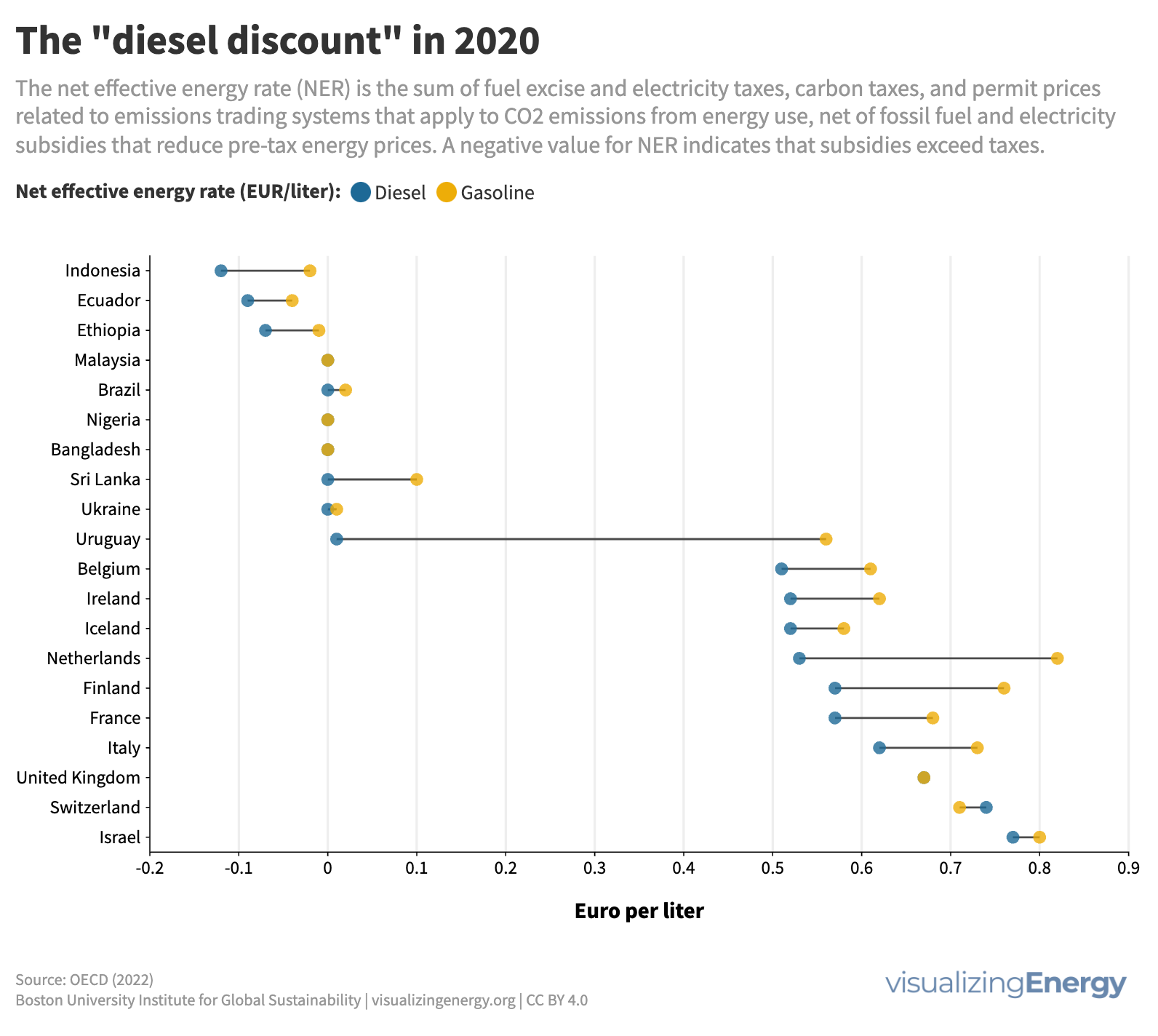

Road transport relies heavily on gasoline and diesel, influenced by government policies that often favor diesel for its efficiency. However, diesel produces more pollution, and the tax revenues it generates complicate change. The debate now centers on speeding up the transition to electric transportation to combat greenhouse gas emissions while balancing historical preferences with environmental concerns.

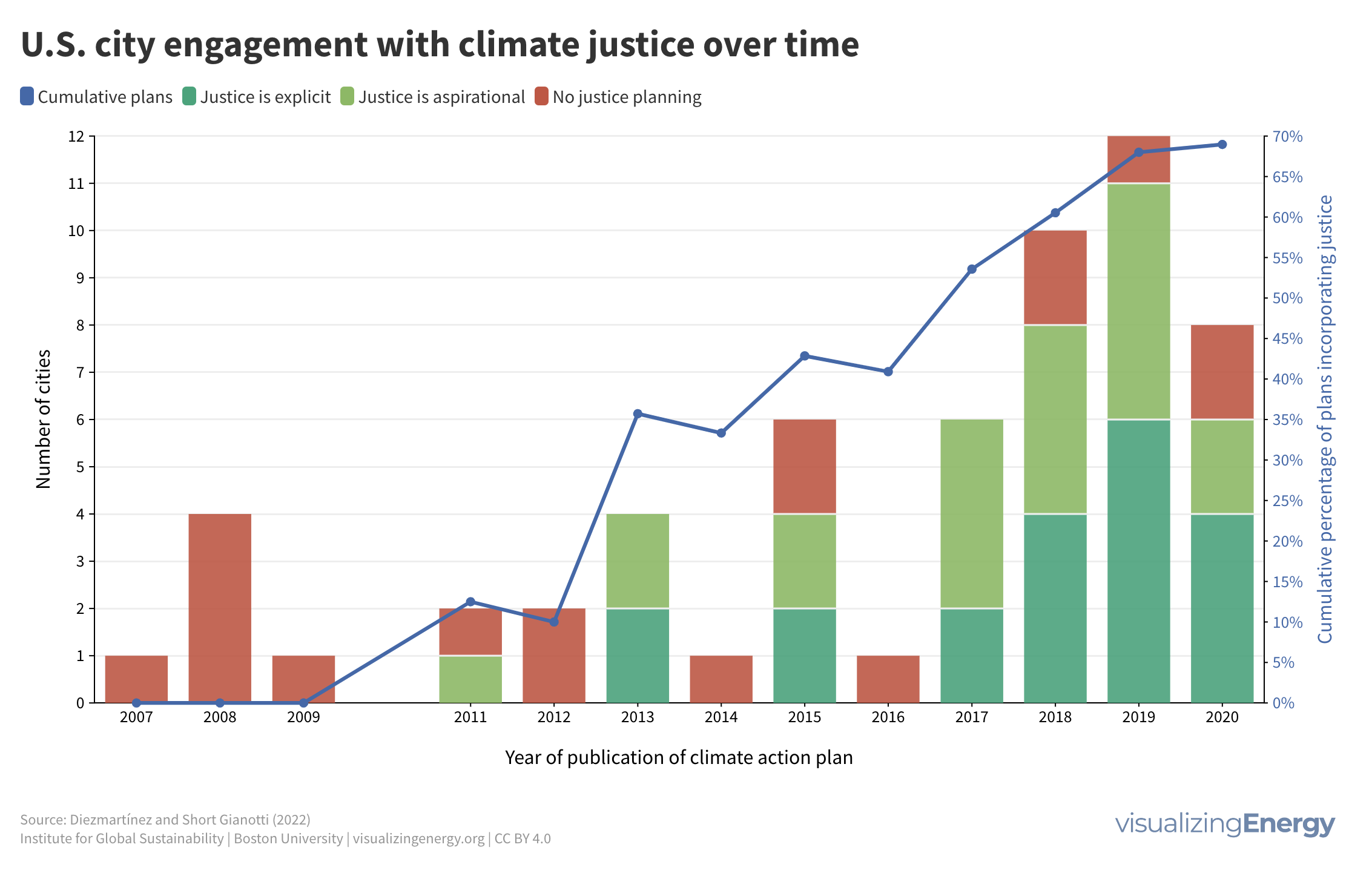

Climate justice recognizes the responsibility of the wealthy for climate change, which disproportionately impacts the vulnerable. Urban climate action plans are increasingly addressing justice, but some cities still lack such plans. Larger cities tend to prioritize justice more, and sectors like energy efficiency and clean energy receive greater attention. More efforts are needed to achieve just and inclusive urban climate transitions.

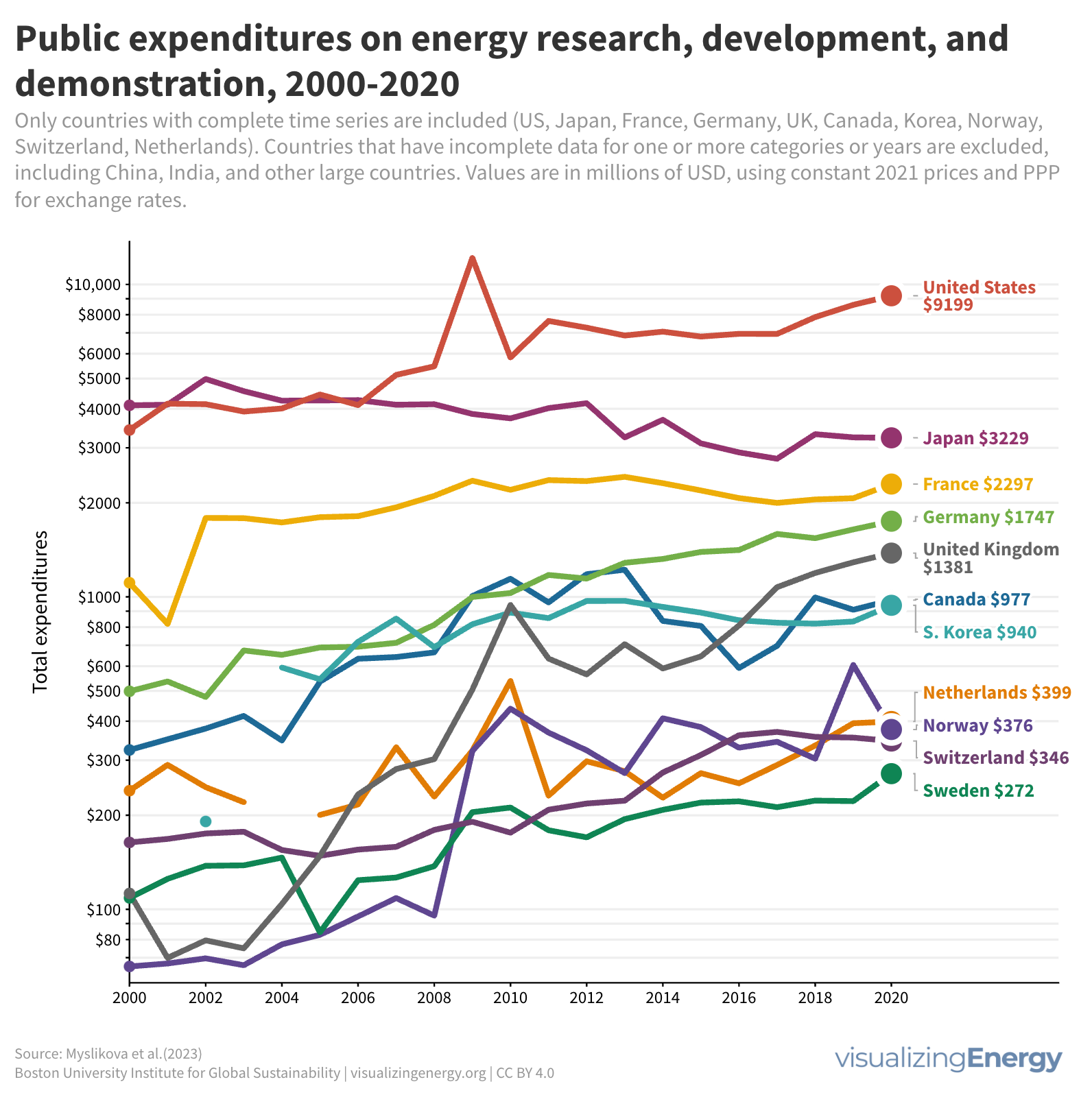

The world energy system is experiencing seismic shifts, with a rapid expansion of low-carbon fuels and energy efficiency. However, fossil fuels still dominate investments despite the need to reduce greenhouse gas emissions. Different countries prioritize energy RD&D in diverse ways, and state-owned enterprises play a significant role.