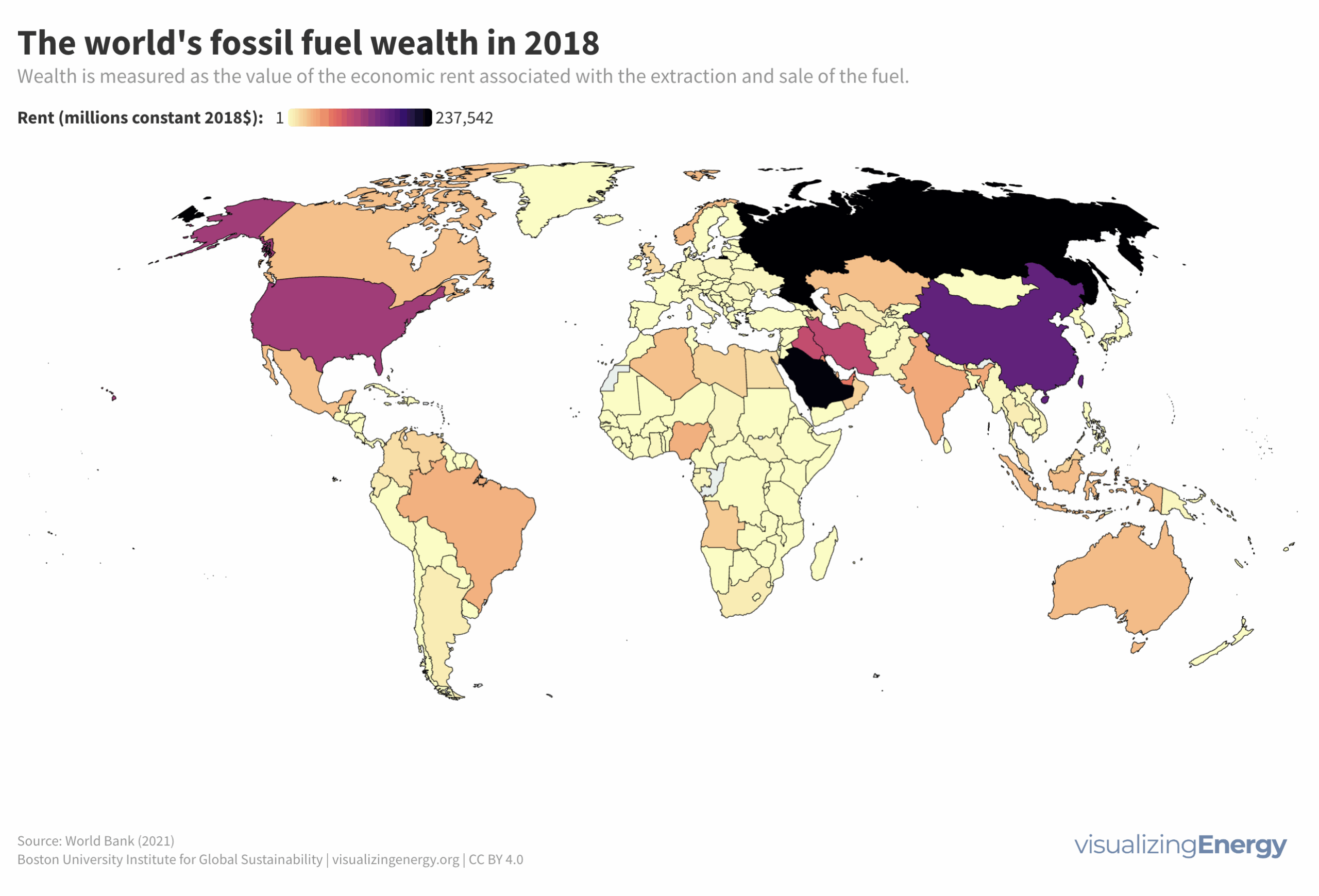

What nations profit the most from fossil fuel extraction?

The well-being of a nation’s population is determined in part by how the nation’s wealth is managed. Wealth has two principal components. The first is

The well-being of a nation’s population is determined in part by how the nation’s wealth is managed. Wealth has two principal components. The first is

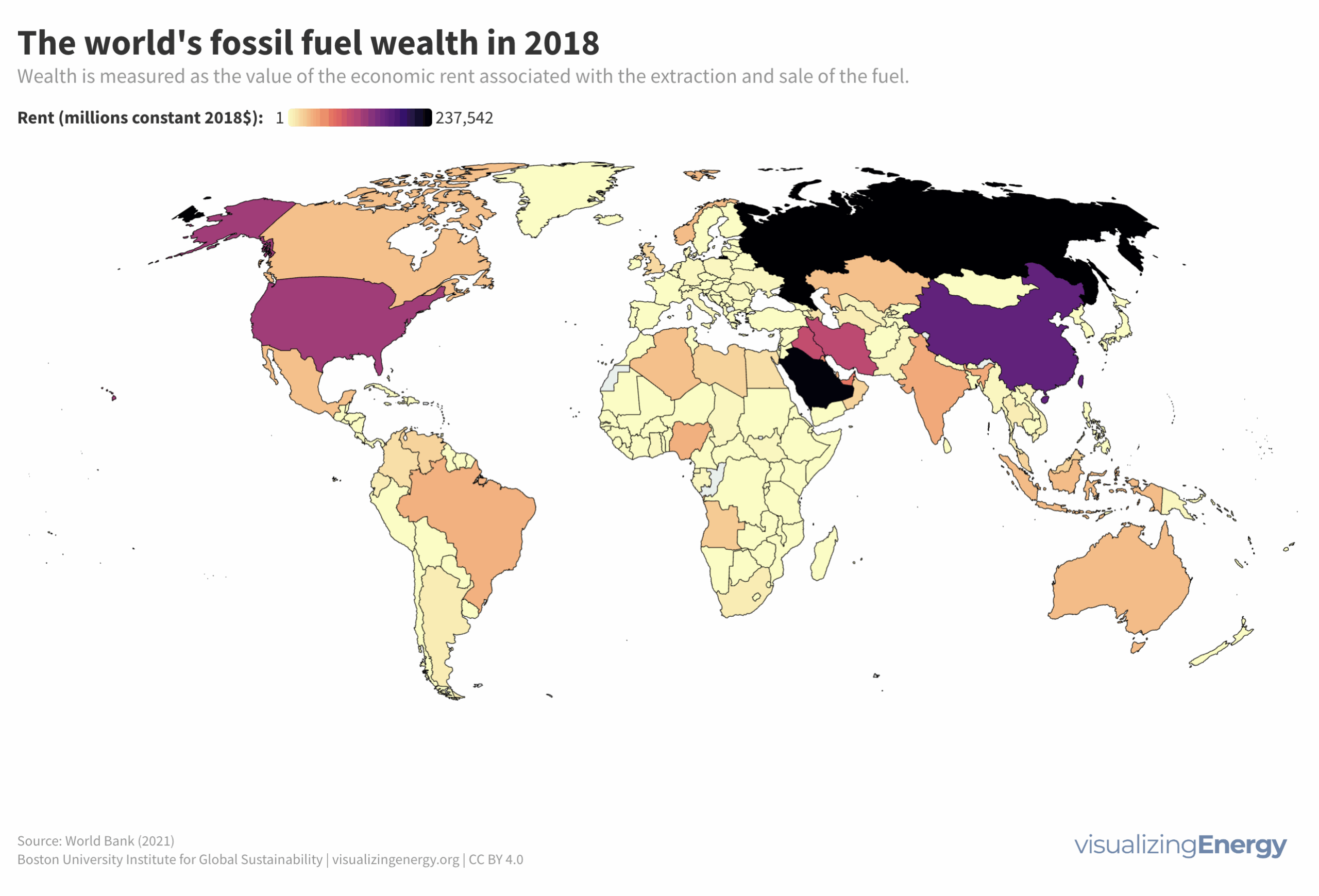

The global energy system encompasses diverse infrastructure requiring extensive investment, with USD 2.8 trillion spent in 2023. Public finance significantly supports energy projects, where fossil fuels received 56% of funding from 2013 to 2022. Clean energy finance increased until 2021, highlighting varying regional priorities and the dominance of large projects in funding distribution.

Global oil and gas consumption increased by 14% from 2013 to 2023, posing a challenge to limiting global warming. JP Morgan Chase led in financing upstream oil and gas activities, providing over USD 67 billion to various companies. Concerns were raised about banks’ commitment to reaching net zero emissions and prioritizing policies allowing the purchase of carbon offsets, which may promote greenwashing. Some oil and gas companies have weakened their commitments to reduce investment in upstream projects.

Electricity plays a crucial role in modern society, constituting 21% of energy use in the EU in 2022 and expected to grow due to initiatives in transportation and heating. The 220 largest electricity companies globally represent about 3% of the total market cap of publicly traded companies. This industry is highly concentrated, with just five companies holding 20% of the market cap.

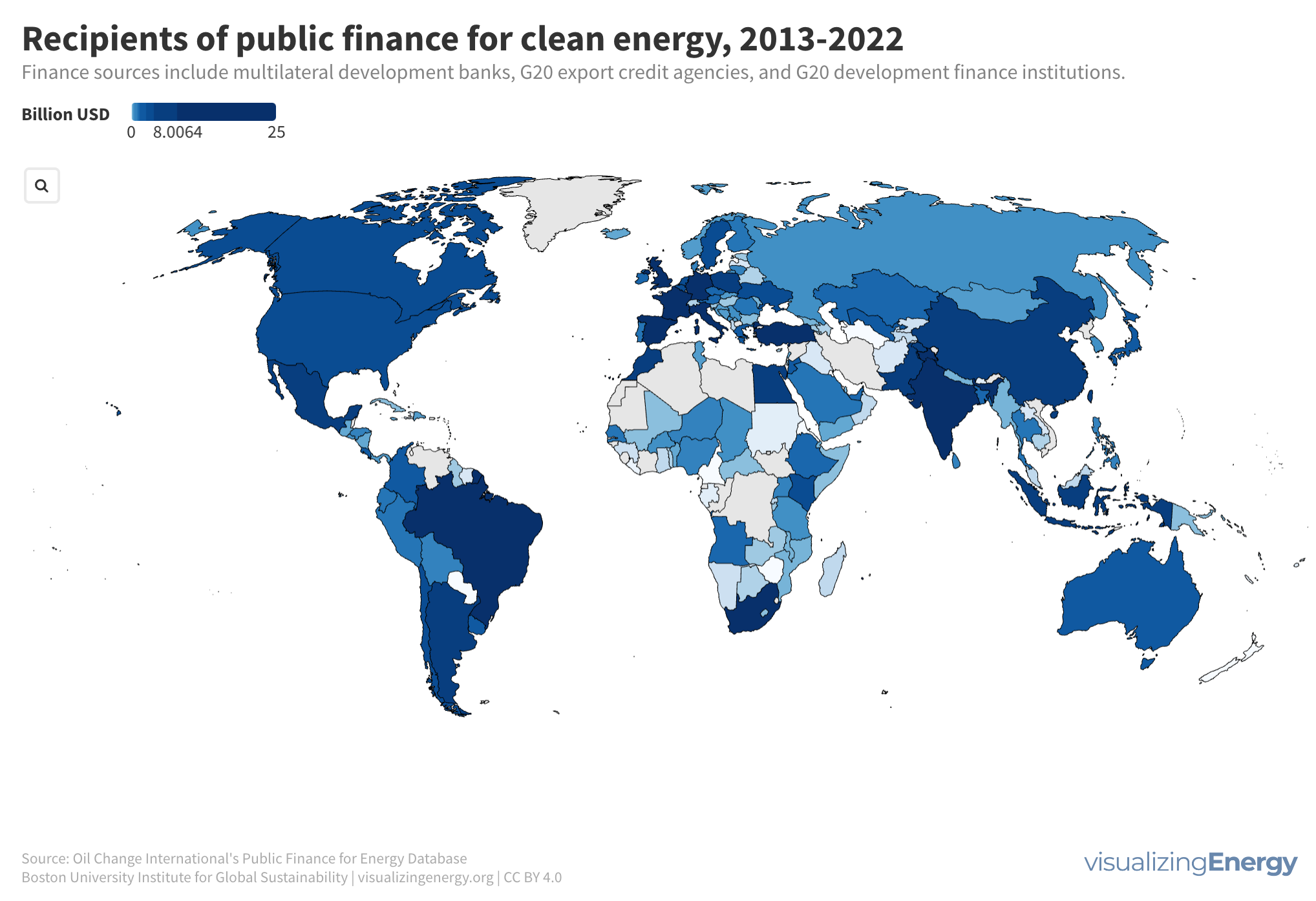

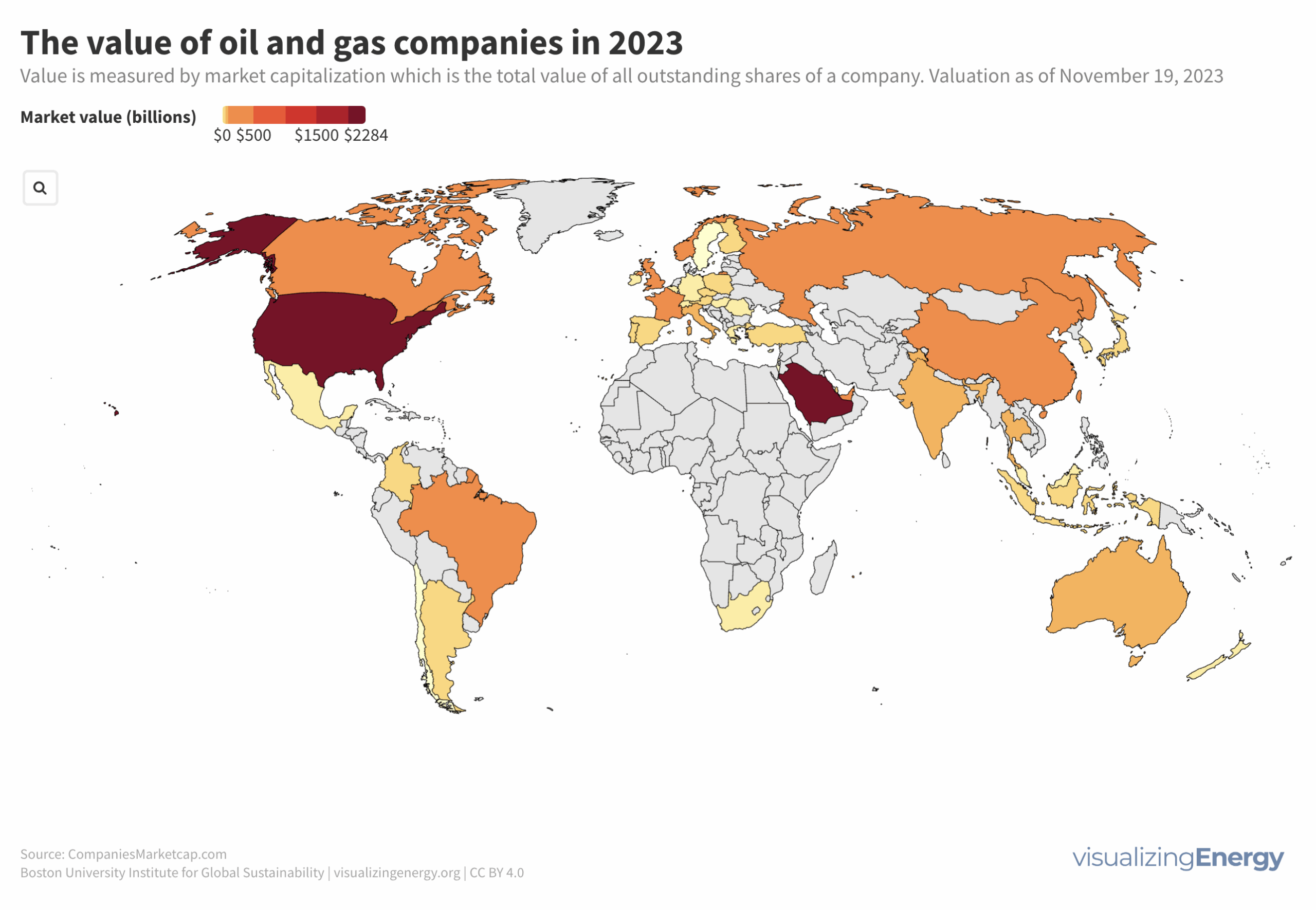

Oil and natural gas make up 55% of global energy use, with the top 350 companies holding a combined market cap of $7.2 trillion, comprising 7% of the world’s largest companies. State-owned enterprises control 90% of the world’s crude oil reserves. Just 8 companies hold 50% of the market cap.

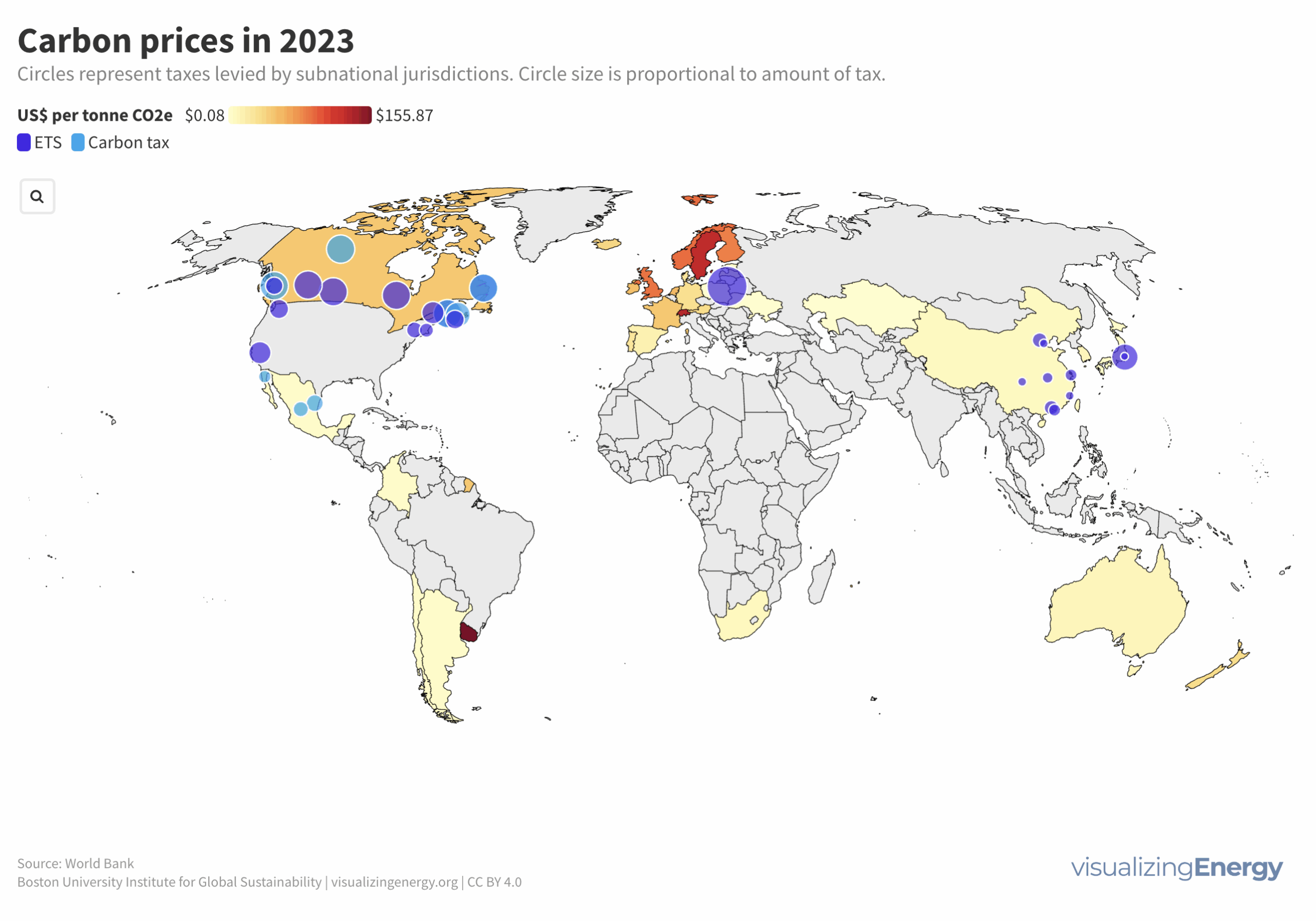

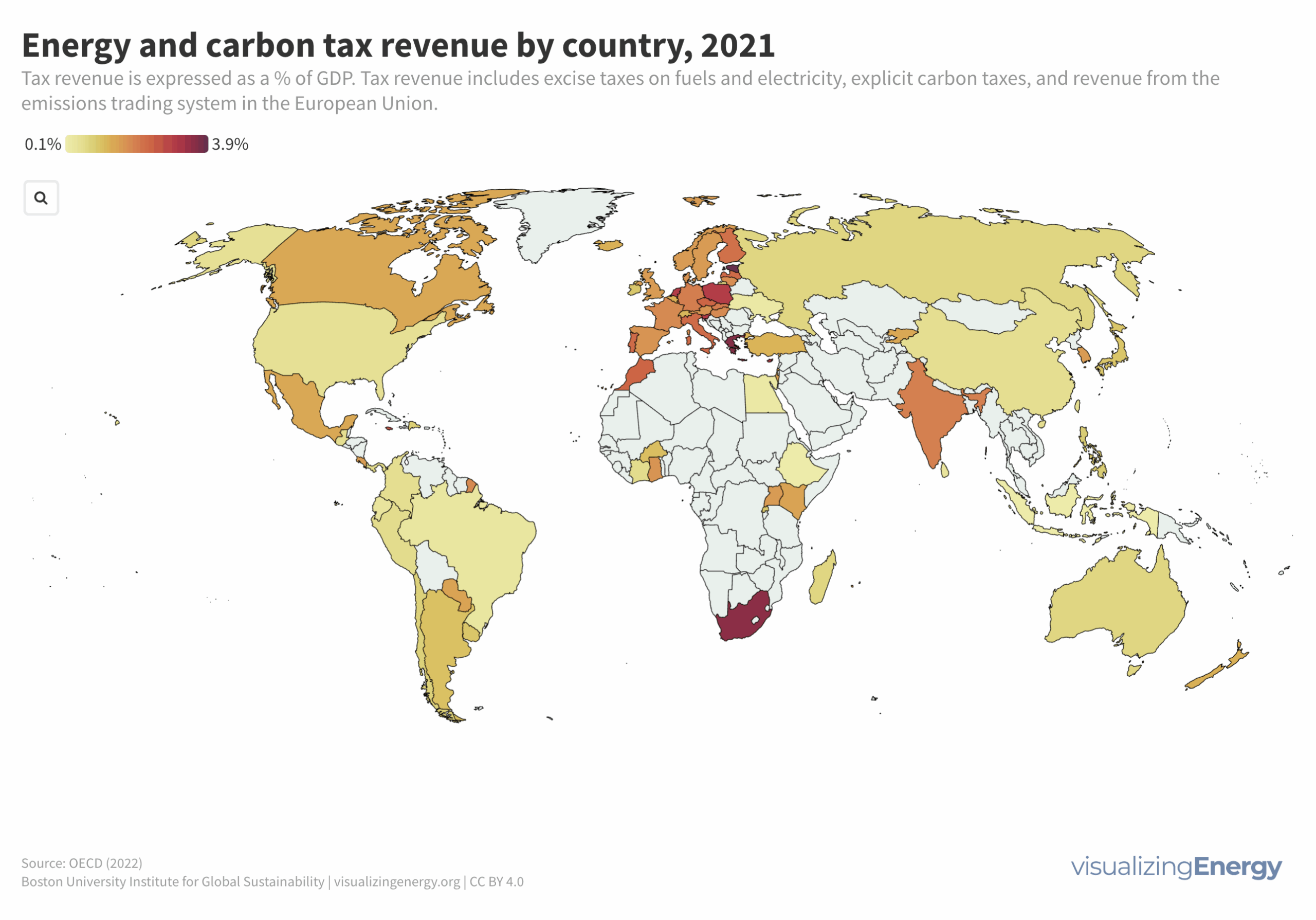

Many experts advocate for “putting a price on carbon” to reduce greenhouse gas emissions and address climate change. This involves capturing the external costs of emissions and linking them to their sources through a price. Approaches include emissions trading systems (e.g., “cap and trade”) and carbon taxes. Currently, 73 initiatives cover 23% of global emissions, with examples in South Africa and the European Union.

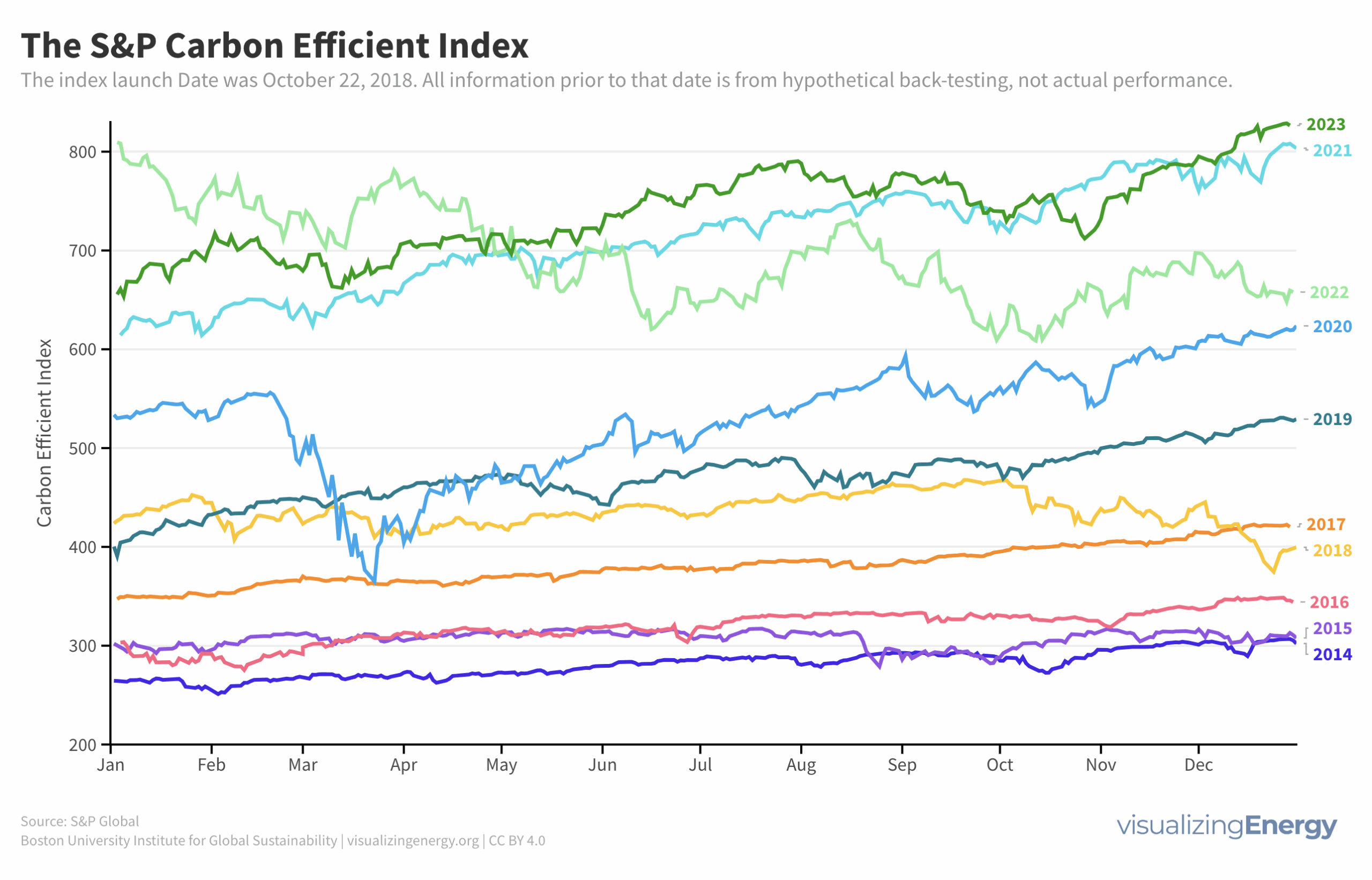

Stock market indices reflect market performance and health. Carbon indices, like the S&P 500 Carbon Efficient Index (CEI), weigh companies based on carbon emissions per revenue unit, aiming for lower carbon exposure without altering industry allocations. Over 5 years, the CEI boasted a robust 13% return, outperforming many major indices.

The Principles for Responsible Investment (PRI) were launched in 2006 by a group of institutional investors and the United Nations to promote sustainable and responsible investment. It has over 5300 signatories in 80+ countries, holding more than $65 trillion in assets. However, there are criticisms about its voluntary basis and enforcement mechanisms.

Major financial institutions’ practices are not climate-friendly, with policies disconnecting short-term targets from required long-term climate actions. A Columbia University report highlights financial institutions’ political influence, using lobbying and campaign contributions, often obstructing climate policy. The report suggests measures for shifting towards positive climate action.

Economic policies impact the volume and nature of energy use and pollutants, including greenhouse gases. Government interventions typically include emissions trading, carbon taxes, and excise taxes. The OECD found that tax and subsidy policies influence GHG emissions and energy consumption globally. Current energy tax policies, however, do not align with GHG reduction goals.