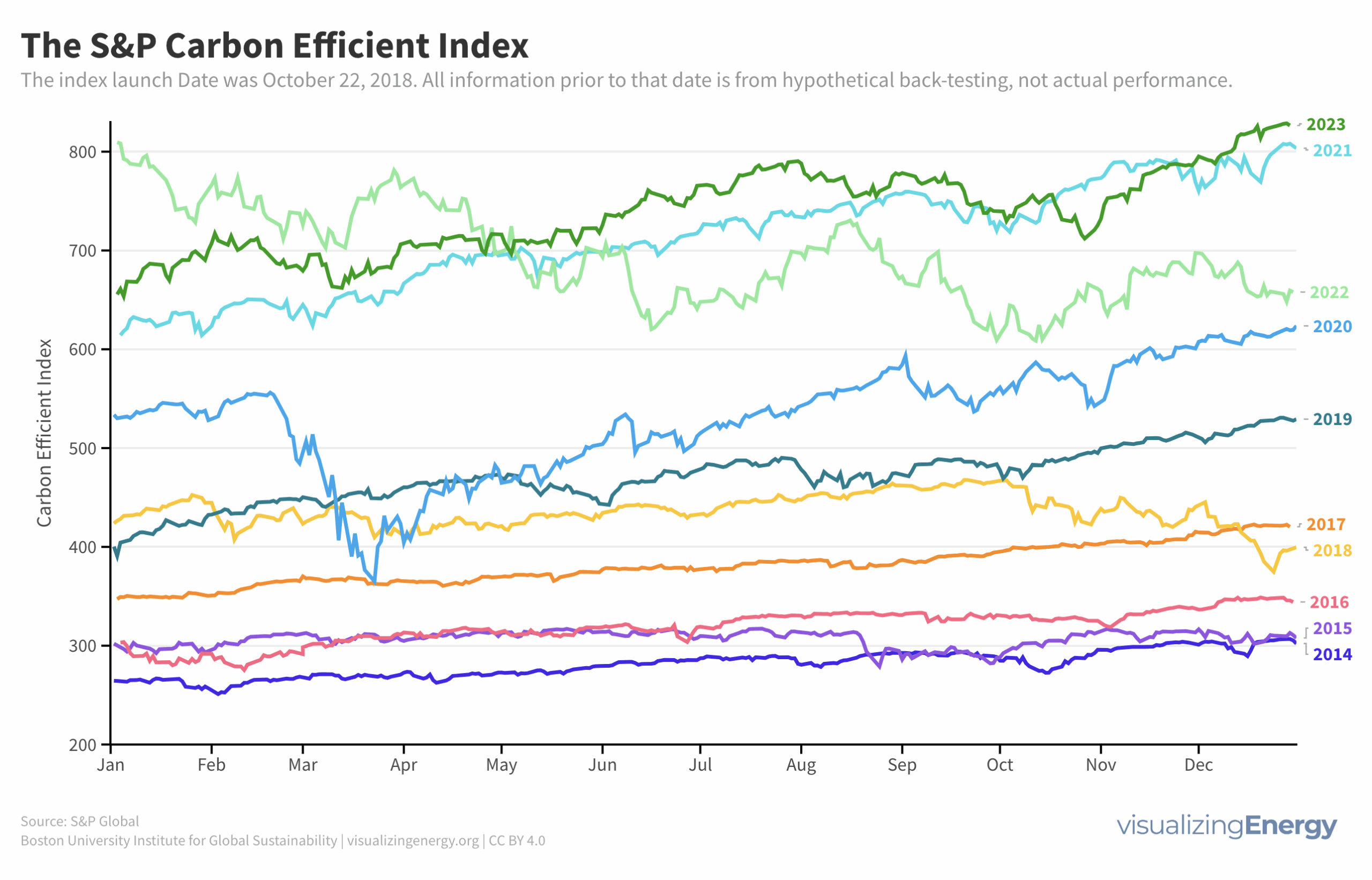

The S&P 500 Carbon Efficient Index

Stock market indices reflect market performance and health. Carbon indices, like the S&P 500 Carbon Efficient Index (CEI), weigh companies based on carbon emissions per revenue unit, aiming for lower carbon exposure without altering industry allocations. Over 5 years, the CEI boasted a robust 13% return, outperforming many major indices.